Business equity is one of the simplest yet most helpful accounting concepts. Some might incorrectly assume that business’ equity tells you how much your business will sell for. It’s actually a concept that allows you to see how your business is valued from an accounting standpoint. You’ll need to know your business assets, liabilities, and owners’ shares in order to calculate individual owner equity.

PART 1 of 2: CALCULATING NET ASSET VALUE

Calculate a Business’ Equity Step 1

Add up the value of your business assets. These include tangible goods owned by the business. For example, office furniture, business machinery, inventory and real estate are all tangible assets.[1] In addition, natural resource reserves and account receivables count as asset accounts. Don’t worry about calculating intangible assets such as copyrights and trademarks, favorable location, community awareness, long-term contracts, and people. Unless there was capital invested (not expensed), these would never appear in the accounting records as assets.

Calculate a Business’ Equity Step 2

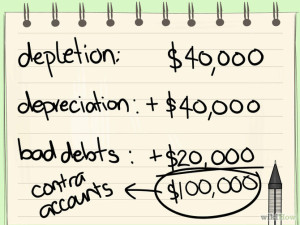

Calculate contra accounts on the businesses’ assets. These include depletion, bad debts, and depreciation of the assets of the company.

For example, if the machinery of a company had a certain value when purchased in 2010, let’s say $100,000, it will have depreciated in value by 2015. You will need to figure out just how much the value has dropped over time. This has nothing to do with market value. For instance, if the machinery was sold it may or may not sell for the depreciated value.

Calculate a Business’ Equity Step 3

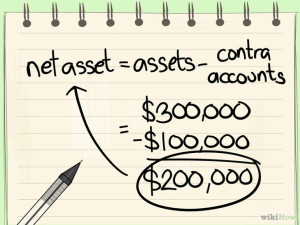

Calculate net asset value. The net asset value is calculated by subtracting the amount of your contra accounts from the sum of your business assets.

For example, if you have $300,000 in assets but your contra accounts on those assets equal $100,000, then you will subtract $100,000 from $300,000, leaving you with $200,000 in net asset value.

PART 2 of 2: CALCULATING LIABILITY AND EQUITY

Calculate a Business’ Equity Step 4

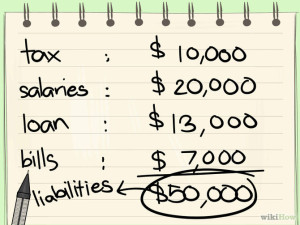

Calculate the total of your business liabilities. Liabilities are financial obligations of the company. You should bring them up to date on the day of the balance sheet. Be sure to include any interest or fees due, but not yet billed or paid (these would be expenses). Examples of liabilities include: salaries payable, interest tax payable, customer deposits, or accounts payable. You will also need to include any contra accounts in your calculations for liability. They could include bad debts, for instance. However, these are rare. The balance sheet represents a specific point in time, so assets and liabilities must be brought current on date shown on the balance sheet.

Calculate a Business’ Equity Step 5

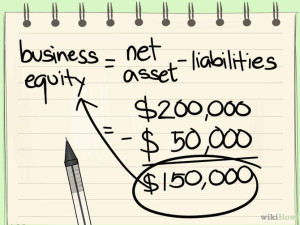

Subtract liabilities from net asset value to get the amount of equity. Specifically, subtract the total of your business liabilities from your business assets. If there’s anything left, this amount is the equity of the business.

Tips

- Specific arrangements for dividing business equity between owners may vary from business to business, and will have been worked out between the owners during the initial investment stage.

- Equity is not how much the company is worth, but an accounting concept of value. For example, public companies usually sell at multiples of book values. Market value is not accounting value.

- Equity is not necessarily the price at which you should sell your business. A sale price will also consider other factors, including that of goodwill, or a business’s value in excess of the owner’s equity. This is typically measured in terms of intangible assets such as brand awareness and good business location.

For additional assistance is determining your business’ equity please contact a Certified Public Accountant.

At PES Design Group we are specialists in Restaurant, Food Service and C-store design and have a staff of knowledgeable consultants with over 25 years of experience in planning innovative, attractive, efficient and profitable C-store facilities. We will use our years of experience to design innovation and uniqueness into your project helping you to set yourself apart from the rest. We can provide you with a remodel design that will help you achieve a greater positive customer experience, top your competition and increase profits!

Don’t take our word for it! Visit our portfolio page at portfolio.pesdesigngroup.com for a list and photos of projects our consultants have done during their 25+ years in the C-store Design Industry as well as testimonials from very satisfied clients.

About the Consultant

Jim Richards (Sr) is a Principal Design Consultant and C-store Specialist with the PES Design Group, Midwest Office. During his 25 years of experience in the C-store Design Industry, Jim has designed many c-stores that are modern, innovative, efficient and most importantly… PROFITABLE.

Jim Richards (Sr) is a Principal Design Consultant and C-store Specialist with the PES Design Group, Midwest Office. During his 25 years of experience in the C-store Design Industry, Jim has designed many c-stores that are modern, innovative, efficient and most importantly… PROFITABLE.